It was just over a month ago that I applied for the NEW Apple Card. I got approved and documented the whole application process here:

What’s so special about Apple Card?

This was the first question that my friends and fans started asking me. After all, it is just a credit card right? On the surface, it is a credit card. You apply and if approved you’re assigned a limit and you receive a physical card in the mail. However, that’s where the similarities stop.

The first thing that makes Apple Card different is the way you apply. If you watched my video above, you’ll note that the entire process happened in the Wallet app on my iPhone. Yes, you can apply for other credit cards on your phone in a browser or a dedicated banking app, but once you’re approved you’re likely to still need to wait for a physical card to show up in the mail. Once approved for the Apple Card it’s immediately available in your Apple Wallet app. You get to use it with Apple Pay immediately. Even if you don’t use it with Apple Pay you can still look up your Credit Card Number, CCD and Expiration Date in the Wallet app so that you can start using it online with places that don’t yet accept Apple Pay.

A titanium card with just your name on it

When you receive the physical card you’ll note that none of your account information is printed on the card. No card number, expiration date or CCD. This is all hidden for your privacy and protection. As I stated above, if you ever needed this info you can see it in the Wallet app on your iPhone. If your card number was ever compromised you could simply update it in the wallet app with a new credit card number and not even need a replacement card.

Next day cash back

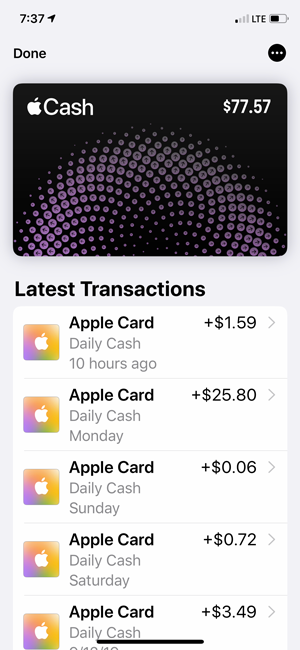

Let’s talk about one of the best benefits, cash back the very next day. Unlike most other cards, cash back doesn’t take a month to see/access. If you buy something today, the cash back is available on your Apple Cash Card the next day. Cash back will either be 1%, 2% or 3% depending on how you pay and the merchant. You get 1% anytime you use the physical card (or the card number). If you pay with Apple Pay then you get 2% back regardless of the merchant. If you buy anything from Apple (products or services such as iCloud storage, Apple Music, etc.) OR one of their Apple Card partners then you’ll get 3% back. Apple has demonstrated that they can add addtional partners on the fly for the 3% back. For example, at launch Uber rides got you 3% back and recently Walgreens was added.

Even though I used Apple Pay at the register I got 3% back instead of 2%. As soon as I typed this I could hear people saying I get X% back on my card. Yes, there are cards that offer higher than 3% for sure. However, in most cases these cards either come with limits on the amount of cash back or limit it by categories or merchants. This means that depending on the purchase it may make sense to use another card. For example, many swear by their airline miles card. Free tickets and upgrades can easily exceed the cash back you’d get in a year. You can’t beat two first class tickets annualy to a vacation spot. It’s all relative to what perks you want most.

With all of that said, I still find that this simple formula for next day cash back pays off and I don’t have to jump through any hoops to use/access my cash back funds. I can either buy things with the Apple Cash Card, pay down my Apple Card balance OR simply transfer the money to my bank account.

I do use other cards depending on the situation and if the points/miles make more sense.When i buy airline tickets it’s hard to beat my Delta Reserve perks. My Amazon card gives me 5% back on Amazon purchases. I buy a lot from Amazon, so that’s my default card there.

No fees of any kind

No foreign transaction fees, no late fees, no annual fees, no hidden fees, no fees of any kind. Most high-end cards have steep annual fees and other fees. This is a welcomed change.

Cash Management Tools built right in

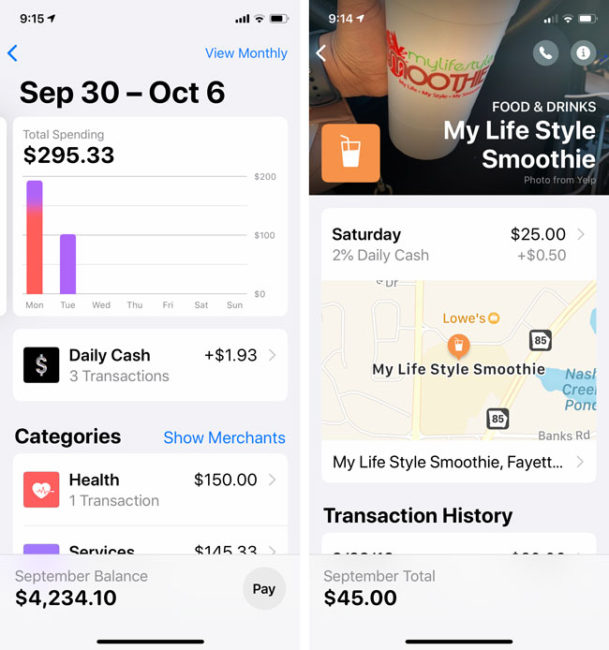

Another thing that makes Apple Card different is that you get to see what your spending easily and quickly. Each purchase is categorized and even mapped so that you can see where your card was used in case the merchant name is not easily recognizable. You’ll know exactly where you spent money. A weekly summary lets you see what you spend your money on.

This is also coupled with an easy to understand Payment wheel. Most cards are geared towards you carrying a balance and therefore paying interest. Apple Card on the other hand makes it easy to see how much you can pay to avoid paying interest. You should also note that no matter which card you use, paying off your balance each month makes the points and cash back work. If you pay interest that will likely exceed what you earned in cash.

The Bottom Line

I have cards that offer cash back and other cards that offer points/miles. I have cards that don’t have annual fees and have decent online management tools. However, like most Apple products, it’s not about one single feature. You can say that another card has this and another card has that. It’s about the entire experience and when you put it all together this is what makes Apple Card a “joy” to use and currently unlike any other credit card out there. I don’t use it exclusively, but I do use it now for the majority of my purchases and many of my monthly bills that can be paid via credit card.